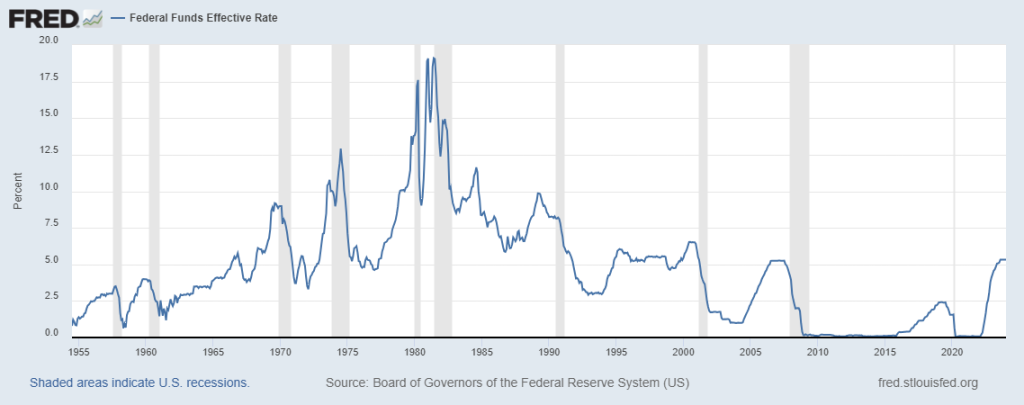

We’ve experienced wild swings in the economy, inflation, financial markets, and fiscal and monetary policy since COVID struck nearly four years ago. With the virus largely behind us, the market focus now is on how the economy and inflation evolve and what the Federal Reserve does in response. Economic forecasters and the Fed expect continued low inflation and a weak US economy. Meanwhile, markets are pricing 125-175 basis points in Fed rate cuts by the end of this year, with 50-75 basis points by July.

This combination of low inflation, deep interest rate cuts, and a barely growing economy doesn’t hang together. There are compelling reasons to believe that the resilience of the US economy is being underestimated, just as it was last year. If the economy continues to grow strongly, the Fed will proceed much more cautiously than markets expect. If the Fed cuts rates significantly in the first half of this year, the economy would accelerate, which would reverse the trend of declining inflation and prompt the Fed to resume rate hikes. That is a situation the Fed would like to avoid at all costs.

Forecasters, markets, and the Fed have been underestimating the strength of the US economy since rate hikes began in early 2022. A year ago, an overwhelming consensus was that the US economy was heading into a recession. Instead, it accelerated as 2023 unfolded, even though the Fed subsequently raised rates by another full percentage point. US GDP growth increased from less than 1% in 2022 to over 3% in 2023, including a quickening to more than 4% in the year’s second half.

The Fed usually begins a rate-cutting cycle after the economy has been beaten up by a recession, not after it has accelerated. So why is that now the overwhelming expectation? The main reason is that core inflation (excluding the volatile food and energy categories) has fallen to the Fed’s target of 2% over the past 7 months despite the pickup in economic activity, suggesting it is no longer necessary to maintain a restrictive monetary policy. After all, the surge in inflation was why the Fed hiked interest rates in the first place.

The other explanation is the widespread view that the US economy will be very weak this year. The Wall Street Journal’s survey of 71 economists produced an average GDP growth forecast for 2024 of only 1%, while the Bloomberg survey projected 0.9%. The median forecast of Fed officials is only slightly stronger at 1 ½%. Rate cuts make sense if the US economy barely grows and inflation remains low.

These weak projections for US economic growth reflect the belief that the economy can’t keep growing strongly due to restrictive monetary policy. After all, the US economy always fell into recession when the Fed hiked rates by as much as it has – over 5 full percentage points in 16 months. Most forecasters and analysts initially pushed out their recession forecasts in the first half of 2023 as the economic data kept beating expectations. But when the economy accelerated in the second half, they threw in the towel and reverted to a so-called “soft landing,” which entailed an extended period of minimal economic growth.

There are several reasons why the US economy will continue to hold up much better than expected, at least for the next 5-6 months. Higher interest rates have indeed tightened bank lending standards and slowed bank lending. But overall financial conditions have eased in response to lower-than-expected inflation and indications from the Fed that it intends to cut rates this year. Stock prices are up nearly 20% since late October, and bond yields have declined by a full percentage point, with mortgage rates dropping by even more.

Moreover, while monetary policy remains tight, fiscal policy has again become expansionary. After falling sharply when the COVID stimulus programs expired, the federal budget deficit for the fourth quarter of last year increased by $90 billion from the previous year despite a strong, one-off increase in tax receipts; federal government spending was up nearly 12%.

Consumer spending—which accounts for two-thirds of the US economy—shows no signs of slowing down. Stronger-than-expected December retail sales figures have already pared back market expectations of a Fed rate cut as soon as March. Looking forward, the labor market can be expected to keep creating jobs at an impressive pace. Surprisingly, job gains have accelerated over the past few months after slowing in the middle of last year. They averaged 289,000 per month over the past three months, up from an average of 255,000 for 2023. Meanwhile, unemployment remains below 4%, equivalent to full employment.

Employment gains should persist since there are still an unusually large number of job openings. There were 9 million in December, below the record 12 million recorded in March 2022 but well above the 6.1 million unemployed people, and the pre-COVID level of 7 million. Meanwhile, wage growth is now exceeding the rate of inflation. Strong job growth and increases in inflation-adjusted worker compensation will continue to boost household income. In addition, consumer balance sheets remain in very good shape. Debt service payments as a percent of disposable income are below pre-COVID levels and well under levels seen at business cycle peaks. At the same time, the recent rise in stock prices has helped raise household wealth to record levels.

Consumption is just one sector of the economy that is performing well. Investment and construction spending have been quite strong, helped by the $2 trillion that the Administration is beginning to pump into US factories and infrastructure. Investment spending rose sharply last year, powered by nonresidential construction, both private and public, which increased by 18% and 16%, respectively. Homebuilding also grew but by a much more modest 4%.

Manufacturing and housing were clobbered in 2022 as the Fed raised interest rates aggressively, but these sectors show little sign of weakening further. On the contrary, there are signs they have already bottomed. Housing has been picking up in response to the recent decline in mortgage rates and a dearth of existing homes listed for sale. New home sales jumped 8% in December, and single-family housing starts (new residential construction) have been rising at a double-digit pace for the past few months.

Turning to inflation, there has been ample cause for optimism. Core inflation as measured by the personal consumption expenditure (PCE) deflator—the Fed’s preferred measure—has been running just under the Fed’s 2% target over the past 7 months, after peaking at a rate over 5 ½% in early 2022. The reduction in inflation mostly reflects an outright decline in goods prices following a COVID-induced surge. The demand for goods—where the jump in inflation was concentrated—fell sharply once people began to reengage in previously off-limits services such as travel and going out to restaurants and entertainment venues. This occurred just as the return to normal eliminated global supply bottlenecks. The weakness in the Chinese economy over the past couple of years has also helped keep commodity prices low, as has the surge in US oil and natural gas production.

While the decline in inflation has been impressive – especially considering the accompanying improvement in US economic growth—it is far too early to conclude that core inflation will remain around 2%. The decline in goods prices, which is largely responsible for reducing core inflation, has probably run its course. Meanwhile, core inflation in services—which has a greater weight than goods in inflation indices—has been running at a pace of over 3 ½%.

In sum, the economy should keep growing solidly over the next six months, and the Fed will probably hold rates steady, with a possibility of a quarter-point reduction in the summer. This contrasts with current market pricing, which suggests 50-75 basis points in rate cuts by July. Suppose the Fed is as cautious as we expect and maintains rates at current levels. In that case, the economy is likely to slow by the second half of this year since, by then, the labor market should be generating much fewer jobs, implying slower income growth. That said, market pricing of 125-175 basis points of rate cuts by year-end is excessive.

As for financial markets, both stock and bond prices have been boosted by prospects for lower interest rates. In particular, the recent plunge in bond yields was largely in response to expectations that the Fed would begin to cut rates significantly and soon. If we are right that economic growth exceeds forecasts and expectations for rate cuts are not realized, bond yields should increase over the next few months.

Stocks have also responded well to the prospect of big rate cuts, but the upside surprise in economic growth has also contributed as corporate profits have rebounded. If the economy continues to outperform, stocks should hold up despite the persistence of high short-term interest rates. It is worth noting that although stock prices have recently reached record highs, they are barely above where they were two years ago despite a much stronger-than-expected economy. Moreover, US markets remain attractive internationally since the US is massively outperforming virtually every other major economy. This suggests the US stock market is not positioned for a sharp pullback anytime soon, barring some unexpected negative event.