The World Economic Forum’s annual meeting in Davos, Switzerland this week aims to address issues that affect the whole world, from technology to economics. The latter issue may be particularly salient in light of a new WEF report. On the opening day of the conference, the organization published the January 2024 edition of its Chief Economists Outlook. In it, 30 prominent economists shared their thoughts on what the global financial sphere might look like in 2024. For the majority of them, the outlook was not encouraging—but opinions varied, especially by region.

Different Economic Stories By Region

To start, the WEF asked the economists a simple question: “Looking at the year ahead, what are your expectations for the future condition of the global economy?” There was no consensus.

“Somewhat weaker” was by far the most popular answer, accounting for 53% of respondents. But “much weaker” accounted for only 3%. As such, 43% of respondents thought the economy this year would be either “somewhat stronger” or “much stronger.”

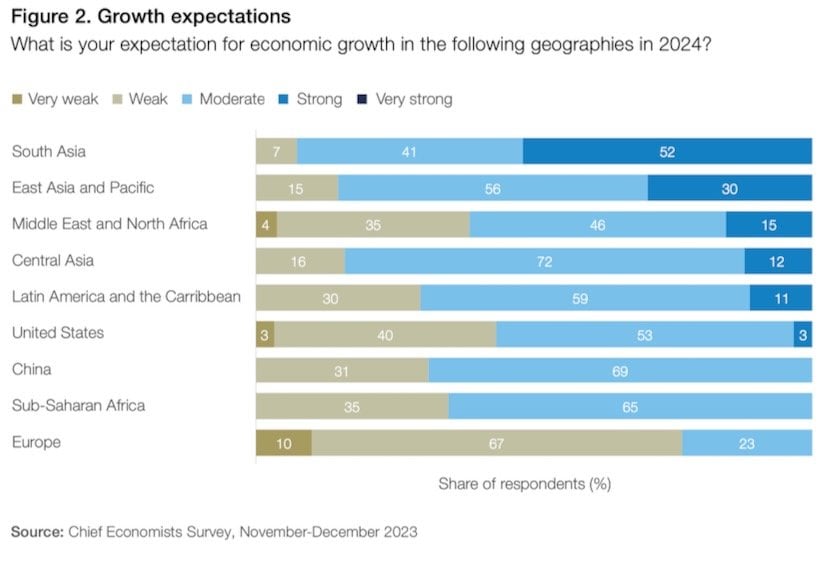

The economists tended to be a bit more definitive when it came to prognosticating by region. A full 77% of them predicted a weak economic year for Europe. Conversely, 93% of them said that South Asia was poised to grow in 2024, and 86% of them said the same thing about East Asia.

The United States fell somewhere in the middle, with 43% of respondents predicted weak growth, and 57% predicting strong growth. Compare and contrast to the Middle East and North Africa (39% weak, 61% strong), China (31% weak, 69% strong), and Latin America (30% weak, 70% strong).

The WEF’s uncertainty regarding the United States is not universal, however. Wilmington Trust, an influential financial service from Delaware, released a similar report last week on U.S. Economic Exceptionalism.

That paper concluded that the U.S. still plays an outsize role in world economics, and that its dominance could continue in 2024. According to Wilmington, universities in the United States draw talent from all around the world, and produce a highly educated workforce. That workforce tends to be flexible, able to switch jobs easily and effectively. The U.S. facilitates about 400,000 new businesses every month, and many of those businesses play into a strong domestic stock market.

The next twelve months will determine whether the WEF or Wilmington hit closer to the mark.

Different Stories By Business Sector

Just as the chief economists predicted different outcomes by region, they also suggested that not every field will grow or shrink equally. When asked which industries were likely to thrive in 2024, the respondents gave only two—information technology and healthcare—their unanimous confidence. Mining, renewable energy, and agriculture got more positive nods than negative ones, while engineering and transportation were split down the middle. The outlook was considerably less enthusiastic for fossil fuels (potentially good for the climate), travel and leisure, financial services, and retail goods.

About one-third of the report focused on the growth of generative AI. The vast majority (87%) of respondents believed that the technology will be “commercially disruptive” in the near future, which is perhaps not shocking. More insightful, though, is their belief that not all regions of the world will benefit equally from AI. A majority of those surveyed (51%) believed that artificial intelligence is “unlikely” to make developing economies more efficient. Likewise, a significant minority (47%) believed that low-income economies will not reap significant benefits from AI for at least five more years.

Worth at Davos

Now that the Davos conference is underway, expect more economists to weigh in on this issue as the week progresses. Worth magazine is hosting three panels on AI in the workplace.