This piece originally appeared in FIN, James Ledbetter’s fintech newsletter.

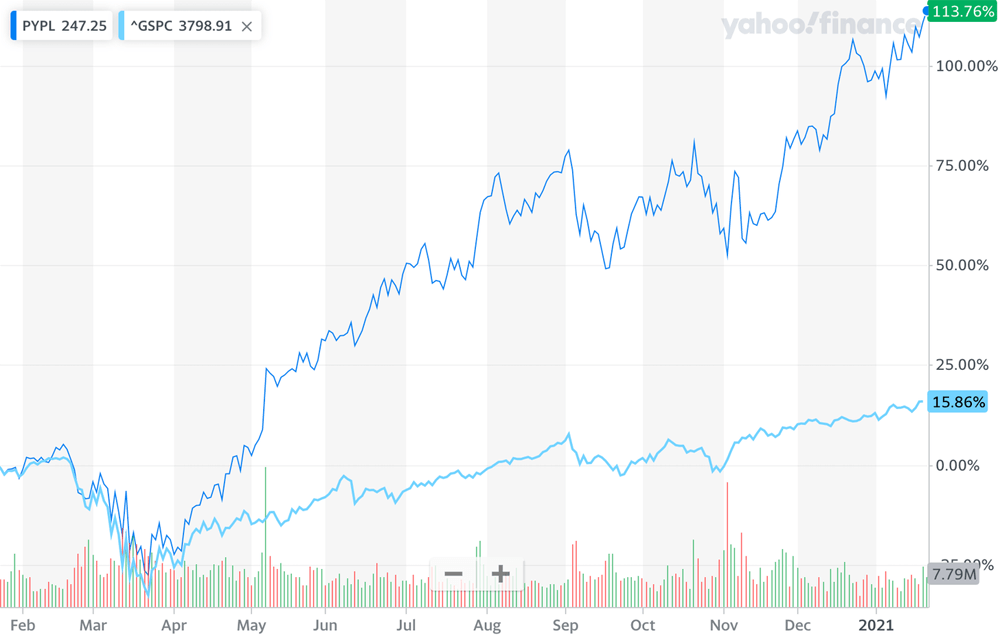

PayPal is arguably the greatest US-based fintech success story; it has completely upended how the world pays for everything, and at last glance its market capitalization was a little shy of $300 billion, in the neighborhood of Disney and Bank of America, and quite a bit higher than Coca-Cola. Much of that market capitalization is attributable to the COVID epidemic, given the dramatic increase in contactless payments since lockdowns began in early 2020. This chart tells the story—until early April, Paypal stock was tracking almost exactly against the S&P 500, and then, boom:

As more vaccines are administered and the world slowly returns to in-person shopping where PayPal is less advantaged, will the company and its stock be able to sustain this breakneck growth? This week, BTIG analyst Mark Palmer made a splash by upgrading PayPal to a “buy” recommendation and predicting that its stock price would rise to $300 a share (up from today’s range of about $240)—and intriguingly, his rationale has very little to do with the easing of lockdowns. Instead, Palmer says that allowing PayPal’s 333 million active users to buy and sell Bitcoin (and three other cryptocurrencies) through the app will provide the company with a long-term boost. The research note says “we believe crypto could add more than $1bn to the company’s annual revenues by 2022.”

Actually, the ability for PayPal consumer users to buy and sell crypto is not the most intriguing part of Palmer’s note. As Barron’s observed:

PayPal now charges merchants a 2.9% fee on a standard fiat currency transaction, and most of that fee is passed along to card networks, such as Visa (V) and Mastercard (MA). But PayPal would likely charge merchants much less for crypto. Rival BitPay charges merchants a 1% processing fee, for instance, and keeps the revenue itself, cutting out the card networks (since crypto is facilitated by blockchain technology).

It’s too soon to know if this game-changing transition will happen any time soon, because it will be a while before a significant number of PayPal’s 28 million merchants allow crypto payments. Given current market exuberance, FIN doesn’t consider Palmer’s $300 price target in any way outrageous (not to say that it’s justified by fundamentals, because it’s not). It’s also true that BTIG sees other tailwinds pushing PayPal forward, including rising revenues and profits from Venmo.

Still, it’s a little hard to stomach some of the paeans to Bitcoin mainstreaming floating around this week. For example, a Motley Fool writer gushed:

Tangential evidence suggests that Palmer is right on the money. Investors need look no further than Square(NYSE: SQ) to get a sense of the opportunity resulting from cryptocurrency transactions. In the third quarter, Square generated total net revenue of $3.03 billion, up 140% year over year, but excluding bitcoin revenue, net revenue was $1.4 billion, up just 25%. That suggests that crypto has effectively doubled Square’s net revenue.

Does this sound a little too good to be true? Take a look at Square’s Q3 10-Q filing. Yes, it’s striking that “Bitcoin revenue” of $1.63 billion has not only skyrocketed from a year ago, but also makes up a substantial part of Square’s overall revenue. However, it’s not like the Bitcoin dropped from the heavens; there is another line on the balance sheet called “Bitcoin costs”—which were $1.6 billion.

And so while a little sobriety is in order, we will have some clues about the validity of Palmer’s view when PayPal announces Q4 earnings on February 3. If PayPal does hit $300 a share, it will have a bigger market capitalization than Mastercard does today.

This piece originally appeared in FIN, James Ledbetter’s fintech newsletter. Ledbetter is Chief Content Officer of Clarim Media, which owns Techonomy.