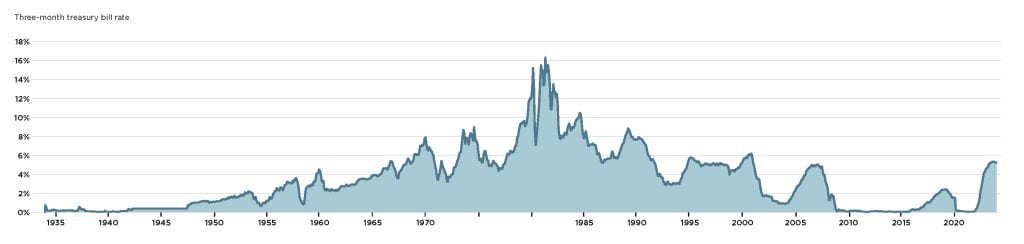

Suddenly, investors can get real income from bonds again. Bonds had been moving up in price, and thus down in yield, for about 40 years—a trend that accelerated after the financial crisis in 2008. “There wasn’t much need for people to look at individual bonds,” says Kevin McPartland of Coalition Greenwich, a major benchmarking firm. “Rates were low, and people, if they wanted a larger fixed-income allocation, they would look at mutual funds or ETFs,” he says, referring to the bundles of assets in exchange-traded funds.

For an idea of how times have changed, consider trends in the 3-month Treasury bill, according to the St. Louis Federal Reserve System. On September 1, 1981, it was a whopping 14.70%; by September 1, 2021, it was just 0.04%. But on September 1, 2023, it was up to 5.32%.

Data from the Fed show that investors are responding to this recent rebound by pouring money into Treasuries and other fixed-income securities. And some ETFs make it easier to trade in Treasuries, as well as in municipal and corporate bonds.

Bonds vs. Stocks

Treasuries are one of the most popular income investments. They are safe, being guaranteed by the full faith and credit of the U.S. Government. They pay a good return. And unlike some lesser-known bonds or those not actively traded, Treasury securities are liquid. There is always a market for them. But how do Treasuries compare to other investments, such as stocks?

McKinsey & Company reports that, for the 25-year period ending in mid-June 2022, the S&P 500 returned 6.8 percent a year, including dividends. This is better than the return of today’s relatively high 3-month Treasury bill, which is a little over 5%. But the risk of losing money is higher in the stock market. Although equity market returns have been higher than fixed-income securities like bonds in many periods, there are also periods—in recent memory—when the stock market has had flat to negative returns.

Bonds offer portfolios a return on money that is parked for expenses that are coming up or might arise. People feel comfortable having cash on hand for such expenses. But with inflation eating away at spending power, it is a waste of resources, especially when an investor can get around 5 percent today in relatively safe, liquid securities like Treasury Bills and investment-grade bonds.

New Ways to Buy Bonds

The growth of exchange traded funds has changed the way many investors approach the stock and bond markets. With ETFs, an investor can pick the asset class they want and buy a package of securities that meets their needs, instead of trying to pick individual stocks or bonds. Owning many securities, even if it is in the same asset class, offers diversification, cutting a portfolio’s concentration risk.

Recently F/m Investments, a provider of financial strategies to money managers and institutions, released the U.S. Benchmark Series Single Treasury ETFs. They make it possible to buy Treasury ETFs during stock market hours and lock in the current on-the-run yield—that is, the price and yield of the latest Treasury offering.

These securities include a full maturity range of Treasury bills, bonds, and notes, from the 3-month Treasury Bill ETF (symbol: TBIL) to the 30-year Treasury Bond ETF (UTHY). But whatever the maturity term of the Treasuries, they remain in the ETF only until the next monthly rebalancing, and then those Treasury funds are rolled into the most recently Treasury offering of the same maturity. This usually changes the fund’s yield. Also keep in mind: The market price of publicly traded Treasuries and other income securities, in an ETF structure or as individual securities, will fluctuate, and money can be made or lost.

But Treasury yields are attractive, especially on the short maturity end. At press time, the TBIL yield was 5.44%, and UTHY was 4.36%, although this yield will change constantly throughout a trading day as the market price changes.

These rates reflect an inverted yield: The shorter-term maturity bonds pay more than longer term maturity bonds. Usually, it is the opposite: Longer-maturity fixed-income securities pay a higher yield because of a perceived higher risk of climbing interest rates, which can cause the security to lose market value.

The US Benchmark Series offers maturity date diversification. As interest rates fluctuate between the series offerings, investors can switch to a higher-yielding Treasury. The ETF series aims (but doesn’t guarantee) to pay interest monthly, another advantage over holding individual Treasuries. The expense ratio—operating costs, including any management fee—is reasonable at 0.15 % per annum.

In July, Alex Morris, F/m’s president and CIO, announced that the US Benchmark Series had raised over $2.0 billion in assets under management (AUM) in less than a year—a substantial amount in that time period. Last May, TBIL won the ETF.com award for the Best New ETF of 2023. “The last thing you should do is worry about your Treasuries,” Morris tells Worth, saying that the simplest construction is to use the current series of outstanding Treasuries for the ETF. That would solve another problem: Treasuries have various maturities. A desired feature in the series, he felt, is that buyers should have access to the different maturities.

Bonds vs. Money Market and Savings Accounts

With the rise of short-term interest rates, some investors would rather keep things simple and hold money market funds, which provide returns by investing in high-quality debt securities. At press time, 3-Month Treasury ETFs had a higher return than many money-market funds, which hovered around 4.35% to 5.15%. But since ETF prices can and do fluctuate, and MMF’s attempt to stay at $1.00 a share, MMFs could be a more stable investment from a principal risk standpoint.

Investors looking for a fixed rate of interest with no market fluctuation could also consider high-interest savings accounts from providers such as CIT Bank or American Express National Bank. At press time, they went up to 5.05%. But that was still below the yield of the 3-month Treasury bill. And these savings accounts may have conditions or restrictions that ETFs don’t. A high-interest account might charge fees, require maintaining a minimum balance, or require leaving money in for a certain time period.

Other Bond Investment Options

Some investors may expect interest rates to dip and want to lock in the high yields of medium- and longer-term bonds by holding them until maturity. This isn’t possible with the US Benchmark, which continues rolling new Treasury issuances into the ETF. Also, there is the possibility of capital gains: The market price of higher-yielding bonds will rise if interest rates drop, and a bond holder can take a capital gain or continue holding.

Invesco offers an alternative with its BulletShares ETFs, which hold hundreds of bonds in each maturity date, those bonds maturing from 2024 through 2033. BulletShares pay interest monthly and are actively traded. (Full disclosure: My clients and I own shares of TBIL and BulletShares.)

BulletShares offers an investment-grade corporate bond series, which has a lower credit risk; a higher-risk high-yield corporate bond series; and a tax-free municipal bond series. Interest rates are attractive. The investment-grade 2026 maturity ETF (BSCQ) had a yield to worst, or YTW—the lowest possible potential yield—of 4.96% at press time. The high-yield series (BSJQ), maturing in 2026, had a YTW of 7.38%; the municipal bond (BSMQ) YTW was 3.03%.

Invesco provides an online “bond laddering” tool. It lets you create a portfolio by selecting the mix of bond series (based on risk/return), the timeframe for payouts, and the distribution of your investment across the various funds.

Unlike Treasury offerings, there is no Federal government backing in BulletShares. Payment obligations are from the issuing corporations in the investment-grade and high-yield ETFs; and local government authorities back the municipal ETFs. Of note: Municipal bonds are known to default at lower rates than corporate bonds, according to the Chicago Fed.

The BulletShares offering has really grown since it launched in 2010. Jason Bloom, the head of fixed income, ETF strategy at Invesco, says he spent two years educating the market about target maturities, helping it raise its first $1 billion. He has since seen the ETF series grow to over $16 billion today and says it is growing faster than ever.

Treasuries are safe and pay a good return. And unlike lesser-known bonds, they are liquid.”

Where is the Bond Market Headed?

Financial advisors feel confident that the Fed won’t be raising interest rates any more in the near future. “Clearly the consensus makes sense, and the Fed is not raising rates at the front end,” says Bloom, referring to short-term interest rates. Bloom said that further interest rate cuts, if and when they are made, all depend on inflation. “The Fed is slowing the economy to slow inflation,” he says, and this year everything depends on “how fast rates are going to come down at the front end of the curve.”

Bloom feels that the curve will un-invert soon, with short-term bond rates dropping and longer-term rates rising. And he sees an opportunity today in mid-term bonds. “I really think that in the 2- to 5-year maturity band is really where you’ll pick up a higher yield, because of the inverted curve,” he says, “and [it] has the most chance for capital appreciation if the Fed cuts rates.”

BulletShares can also effectively be used for bond laddering, as the following graphic shows.

There is an opportunity to receive a good return with a reasonable risk today in the bond market, and new financial products make it possible to select the degree and type of risk that you want. The objective of using them is the same as it has always been in this market: get a good return and understand what the risks are and how to avoid or minimize them.