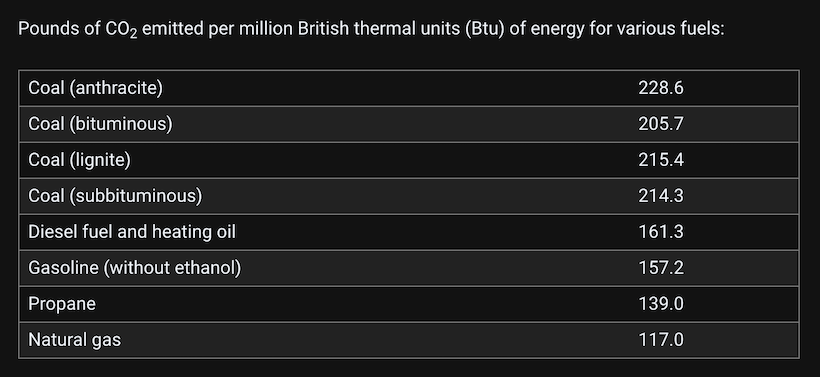

Coal has long been the greatest climate villain, a carboniferous Darth Vader or Voldemort (I said it). As the environmental movement reenergized with Earth Day 1990 (my freshman year of college), one angle was basically: Let’s at least start by switching to natural gas. According to the American Geosciences Institute, coal can emit from 76% to 95% more CO2 per unit of energy than natural gas.

So gas looked like a good interim step toward zero emissions—like buying a hybrid car years ago, before EVs went mainstream. And natural gas has been a friend to alternative energy—primarily solar and wind. It serves as a “dispatchable” source that fills in when they run low, allowing the expansion of green energy without raising the risk of blackouts.

The Dark Side of Natural Gas

The estimates for lower greenhouse emissions assume that none of the gas leaks on the way to the power plant—but it often does. Natural gas is primarily made of methane, which is up to 100 times more heat-trapping than CO2. So, depending on logistics, the combined carbon dioxide and methane pollution can make natural gas as climate-threatening as coal.

And natural gas is booming.

Take the U.S. From 2005 to 2019, coal declined from powering 50% of electricity generation to just 23%, according to the U.S. Energy Information Administration. Meanwhile, natural gas’s share jumped from 19% to 38%. This has brought down CO2 emissions substantially, notes the Administration.

Thanks to technologies like fracking, the U.S. has become by far the biggest gas-drilling country. And in 2023, it became the world’s biggest exporter, through shipments of liquified natural gas, LNG. That’s becoming a big problem. While renewables are growing fast globally, so is gas—further dashing the already-meager hopes that the world could curb climate change before it’s too late. (Technically, it already is, as the world just officially passed the 1.5C warming threshold. But things can still get even worse.)

Curbing LNG Exports

Against this backdrop, the Biden administration has taken the surprising step to pause the permitting of new LNG export terminals in the U.S. Surprising because this is an election year, for a President perceived as weak on economic matters, running against a popular rival who literally chants,” Drill baby drill!” at rallies.

Going after gas could be a bolder move than Biden’s landmark Inflation Reduction Act of 2022. The law may not have helped inflation (the Fed did that). But it made a lot of investors happy, with hundreds of billions in tax credits for developing and deploying green power. The IRA was the carrot that many investors have been happily munching on.

The LNG pause is the stick—gaining some kudos from environmentalists but doing little to help Biden’s chances with the other voters he needs to win over. Four of the top-five natural-gas producing states—Texas, Louisiana, West Virginia, and Oklahoma—are probably lost causes for Biden in the November election. But the second-biggest gas producer, Pennsylvania, is pretty much a must-win. That an embattled President would take such a political gamble is a sign of how dangerous the continued growth of natural gas could be for the planet.

Can Batteries Replace Natural Gas?

But what about that enabling role gas has played in growing renewables? No technology will ever keep the wind from slacking or the sun from setting (unless space-based solar power somehow becomes practical). So what can fill the gap? The most-likely answer is batteries—but probably not the lithium-ion cells in your phone and (maybe) your car. They’re expensive and don’t easily provide the long, steady discharge needed to keep the lights on at night.

With wind and solar already established as cheap and reliable (within their inherent limits), the true frontier in green energy is batteries. Big new ideas are needed here, and plenty are coming. Along with other types of chemical batteries, concepts for storing energy include pumping water up a hill, hoisting weights to the top of a tall building, and heating up some medium, such as molten metal.

One of the wildest ideas in that last category comes from Fourth Power, which has won funding from California-based DCVC to expand its tech. Its system uses electricity from sources such as solar power to melt tin. Heated to 2,400 C (4,350 F), the metallic soup is contained in a carbon vessel that gets so hot it shines. And that shining powers, yes, more solar cells. So maybe there actually is a way to make the sun shine at night—if it’s first bottled in liquid metal.

None of these far-out technologies is far enough along to look like a sure bet. As Asegun Henry, founder and CTO of Fourth Power, told Worth, “What we have to learn is how to scale it up. That’s what we are going to focus on for the next couple of years.”

Investment Challenges

His biggest task may not be making the tech work, but making it work better and faster than so many rivals. Kara Rodby, of energy storage focused-VC firm Volta Energy Technologies, says there’s no shortage of battery tech. A big challenge is for any one firm to stand out with defensible intellectual property to make it appealing to investors.

But there’s tremendous interest, including financial interest, in finding some technology that can rule the power-storage industry. Grid storage is one of the technologies eligible for generous IRA support. The challenge will be developing the tech fast enough, and as an appealing enough investment for fast, wide-scale deployment, to counter the relentless march of natural gas.

Tough, but fascinating, topics like these will be on the agenda at Worth’s Techonomy Climate West conference in Silicon Valley on April 3. Please join us.