This piece originally appeared in FIN, James Ledbetter’s fintech newsletter.

For centuries, the relationship between individuals and investment has been almost entirely siloed. There is you, and there is your banker, and there is a lot of legal and structural scaffolding to make sure that no one gets in between that relationship. Widening out a bit, there are stocks and bonds and other ways of pooling financial resources, yet even then the individual usually invests through a broker, and the typical shareholder doesn’t know much or anything about other shareholders.

That model of an isolated, single-channel connection to financial value is changing dramatically. In the near future, it seems obvious there will be financial assets that are not only shared but genuinely interactive—and in some important sense created by the investors themselves (which is not true of existing securities available to most individuals). Instead of, say, buying a stock and regularly checking its performance, many future investors will log into a collective financial playground, figure out what investments make the most sense, and in essence create and market them together in real time. Investing will look less like a savings account, and more like an Instagram pile-on or a fantasy sports league.

There are sketches of this future all over the place, notably in NFT and crowdfunding markets. This week a London-based company called Visionrare launched a platform allowing people to invest fantasy shares in tech startups, to be awarded payouts in real cryptocurrency. As Sifted (the must-read fintech publication from the Financial Times) put it in a somewhat hyperventilating article:

Today a new fantasy startup investment game launches. Players can buy and trade virtual shares in promising startups, and earn real crypto dollars for collecting the best portfolio. It’s like being a VC — players scout companies, place bets, watch them boom or bust — without any of the pitching, board meetings or… equity.

“We’re on a real mission to democratize access to the excitement of startup investing,” says Jacob Claerhout, cofounder of the platform, Visionrare.

The Visionrare platform is very cool, a bit like EquityZen but with many more options. The list of startups available to invest in is the Y Combinator cohorts from Winter 2018 to Summer 2020, and investors can choose whether to get in at pre-seed, seed, Series A stages, etc.

Before projecting this model too far forward, though, there are several asterisks that belong next to it. One is that of course some versions of collective investing have existed for some time. It’s evolved over time, but Motley Fool’s CAPS community has been around since the ‘00s, and allows stock investors to compete based on the performance of fantasy portfolios.

Another asterisk is that what Visionrare launched is almost certainly illegal in this form, and it’s clear the founders did not think through the implications of what they have created. Not 24 hours after coming online, a Visionrare blog post said:

For the last couple of weeks we worked on building the minimal viable product of a game that brings this idea to life. However, during this process we underestimated the legal complexities and decided it is best to hold off on some of the initial dynamics. We are convinced that startup investing is a fascinating, exciting and educational experience that should be available to a wider audience, but we want to make sure we build a product that is mindful of all the intricacies that come with this mission.

There at least two problems with the original version of Visionrare: one, NFTs that derive their value from a company’s performance looks a lot like a security, and allowing them to be bought and sold would require Visionrare to register with numerous regulatory agencies where it does business. Two, Visionrare didn’t even have permission from the companies themselves.

Nonetheless, the Visionrare platform is the logical culmination of a number of fintech trends. For starters, there is equity crowdfunding, which is still tiny in the United States but is on a pace to hit about $500 million invested this year, and is growing at a 70% annual pace. Then there are the sites—like Carta and EquityZen—that allow accredited investors to buy shares in private companies. And then there are outfits like Republic, which allow investors to put money into music and artists and get paid on the basis of future royalties.

It’s a safe bet that transferring value between individuals and various institutions—equity markets, decentralized autonomous organizations—and between various cryptocurrencies and traditional money will get easier and cheaper over time. Despite Visionrare’s stumble into the market, it gives a clear glimpse of where investment is headed.

The Atlas of Bitcoin

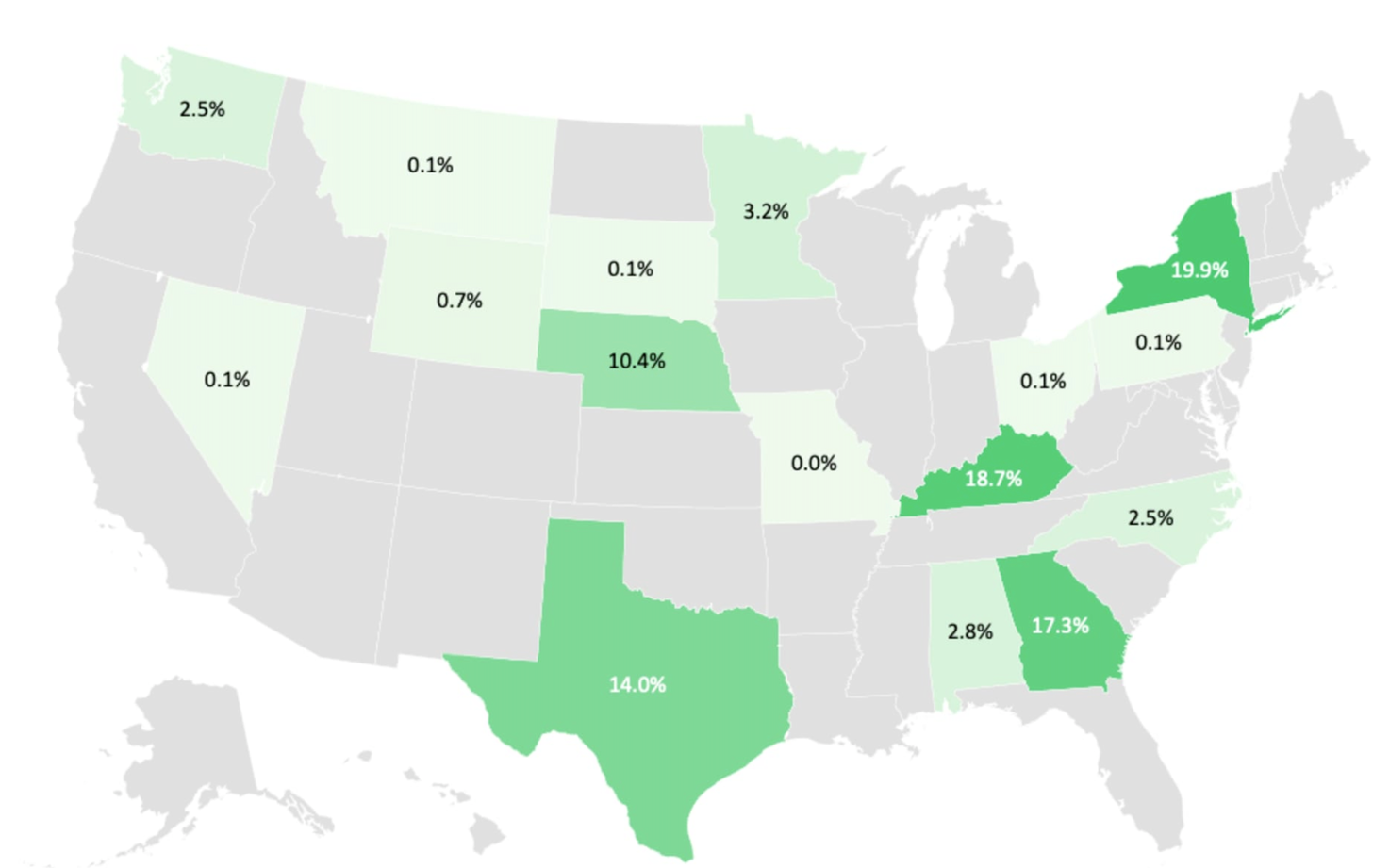

CNBC.com has published a fascinating deep dive into where Bitcoin mining is happening in the United States, particularly in the wake of China’s crackdown. The highlight is this map, provided by the Bitcoin mining advisory company Foundry:

It may surprise some to see New York State in first place, given a) the perception that everything in New York is expensive and b) the New York State law implemented in 2015 that pushed a lot of crypto business out of the state. Less surprising is the prominent role of Kentucky; earlier this year, its state government implemented generous tax benefits to Bitcoin miners. What the CNBC article makes clear is that this map can also be read as a guide to cheap, plentiful and renewable energy, which Bitcoin mining eats a lot of. The article also notes that the movement in New York State to ban Bitcoin mining for three years pending an environmental assessment seems to have cooled off.

This piece originally appeared in FIN, James Ledbetter’s fintech newsletter. Ledbetter is Chief Content Officer of Clarim Media, which owns Techonomy.