The following transcript has been lightly edited and condensed for ease of reading.

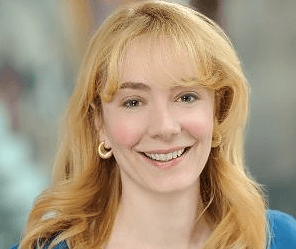

David Kirkpatrick: … Karin Klein who is a venture capitalist at Bloomberg Beta and somebody who I have known for a long time and is a good friend of Techonomy and a good friend of New York. When we met, you were saying you were really excited about the wellness tech that you were thinking of for all kinds of reasons, not necessarily for investing in but as an example of the innovation that’s happening in technology.

Karin Klein: For sure, I mean, I feel like we’re getting so much data and I think one of the examples I shared was Matt Walker did a talk about how if you had one—they do an experiment every year, it’s called Daylight Savings Time and if there’s one hour less of sleep, there’s a 24% increase in heart attacks. And I just thought it was like—

Kirkpatrick: That’s a big study that was done using huge datasets.

Klein: Yes, using the human population of I think 6 billion or so. And so that’s what I think is fascinating is now we have all this data that we can actually use the data for predictive good and I think, like, your cover shows, it’s just a question of do we use it for good or do we use it—how do we use these tools that are available to us.

Kirkpatrick: Where are some other areas maybe where you are investing where that argument holds that you’re excited about?

Klein: So we focus on the future of work, which I think makes sense as an endeavor because we’re all spending so much time working, it should be something we enjoy. And I’ve seen the powerful benefits happen in something like security where, you know, again, using the example of a staggering amount of data, a typical company might have up to a billion threats on its network a day. And so there’s no way without having some augmentation through technology that you can scan through that to figure out which ones to prioritize. So security is an application where we can use AI for good. It’s also part of what’s figuring out our defenses or where there are gaps in our defenses. So, there’s kind of that race of always having to keep pace. But security has been a big area of interest to us.

I also think another area that’s a New York area is tech-enabled real estate.

Kirkpatrick: Yes, right.

Klein: And just the ability to be able to bring people together is kind of an interesting new—

Kirkpatrick: Which is a theme that’s been repeatedly coming up at this conference from Heiferman yesterday and Doug Rushkoff this morning. How are some of the ways that might happen that you’re excited about?

Klein: Yes, and I agree, you know—

Kirkpatrick: This WeWork, is that what you mean kind of thing?

Klein: Well, in some ways it is. I mean, we’re investors in something called Knotel, so I’d also like to note that one.

Kirkpatrick: No, Knotel is a great company. We love those guys.

Klein: We like to put that one in there. But the whole—

Kirkpatrick: I didn’t know you were invested in them.

Klein: Yes, early investors.

Kirkpatrick: Great people.

Klein: Great people. And the reality is yes, I mean, it doesn’t make sense, I work with startups all the time and it might be one person the day that we invest and then the next day they have three people and then a week later they have, you know, five people. And so—and then even a month later, they might even be more. And so you really can’t sign a 10-year lease. And so the ability to parse and have more flexibility around real estate has been a very interesting opportunity and it’s, in part, enabled by tech, just having the mindset of trying to not accept what’s normal and figure out—you know, a 10-year traditional lease doesn’t make sense, how can we think of a way to get around that for potentially helping startup founders?

Kirkpatrick: The worry I have around that, especially in light of what we’re seeing with Uber already and especially thinking about WeWork is that has got to be a highly cyclical business. I mean, businesses would have short-term leases because they grow up really fast, they could shrink really fast in a downturn and the people that are holding the master leases could get in trouble, right? I mean, that’s got to be a concern.

Klein: I mean, it’s very much a concern. The reality is, though, that having that flexibility, like, somebody who gets unemployed might want to still have a place to go to work, there might—it’s one of the times I love investing the most, which is during the times when money isn’t so readily available because I find the best founders want to start companies during that time because they just believe in what they’re doing and it doesn’t matter what the market says, you know, what’s happening in the macro market. So there are some countervailing things that would happen.

Kirkpatrick: Maybe it’s an economic smoothing element, maybe it—

Klein: It could be. Well, we’ll see. And then the other thing that’s kind of fascinating about the WeWork and it just shows, it just leads us to add a question, is WeWork is valued at over two times Boston Properties, right? Boston Properties owns real assets, office buildings, has about a $20 billion market cap and so there is this huge premium that’s getting paid on it, is that premium justified? Hard to tell, but there is a real business in WeWork.

Kirkpatrick: And you, though, invest in really early stages. You’re a VC but you’re like borderline angel investor, right?

Klein: Yes, I’d love to be considered an angel, thank you.

Kirkpatrick: You really do. You find people at super early stages and you’ve had a good track record with that. And AI is a big interest of yours. Can you just talk a little bit about how you see that right now?

Klein: So yes, so we were probably one of the first firms to raise our hand about six years ago when we launched the funds and say that we were interested in AI. We call it machine intelligence because we do want to see there be more of a human—instead of a human dystopia, there to be leveraging machines for useful opportunities. And, yes, there are so many jobs that are dull, dirty, and dangerous, and we’d love to find a way to use technology to—whether it be heavy manufacturing and keep people from being at risk, surgeons, getting them more precision. I mean, we see there being a really powerful combination in the cyborg kind of model.

Kirkpatrick: That’s a good way to think of it. Now, you work for Bloomberg, it’s basically Mike Bloomberg’s money, obviously—and you’re a very passionately committed New Yorker yourself. So New York is a big part of your positioning, mindset and work. How do you see New York as a tech town and how do you see that evolving?

Klein: Yes, so I feel really fortunate to be able to work for Bloomberg and to have such an outstanding entrepreneur that has given us our name and our capital and, yes, I must say, I’ve been an early evangelist, you’re going to hear from John, he as well. We all feel like we’ve seen New York start to come into its own. And it has been wonderful. I mean, when you look back and seeing the evolution and all these different—that’s one of the things that I think makes New York special is it’s diverse in so many ways. I mean, from the nature of the industries that we have, from the nature of the customers that our companies have the good fortune to work with, and then even from the demographics of the founders and our co-investors. I think it’s just a healthier community.

Kirkpatrick: Yes. So but I know—and just to sort of set up the next speaker, John Borthwick, who is a friend of both of ours and also a New York-based investor, despite all your optimism and your finding great things to invest in, there are things about tech that are of concern right now for you. Talk a little bit about that.

Klein: Yes, for sure. I think we’re in a kind of precarious time, right? And Doug’s comments, you know, at the TED conversation where Carole Cadwalladr was calling out Facebook’s role in Brexit. I just—it’s one of those where, you know, we have the power for tech to do so good but there is this tension as to where it could go. And one of the things that is encouraging, at least to me, is that we’re calling it. I mean, there’s enough time, right? Like, AI is still in its infancy, we’re in the first inning, even though I’m not as good with analogies, we’re in the early days of where that is. I mean, what’s being automated right now are simple tasks, it’s not jobs, it’s tasks.

And so I think there’s just so much opportunity for us to get in front of it and to use tech for good. And that’s what I’d like to see happen. And I do say, like, you see the Uber IPO and some of the concerns around it, tech for good means treating people well and paying employees and not trying to arbitrage on benefits, right? And so that’s the kind of models that we’re looking for and the kind of people that we want to work with are people that are capitalizing on using technology for good.

Kirkpatrick: Good, well, that’s great. Anybody have a question or comment? Could we get the lights up real fast? I have more. I mean, you brought up Uber—we don’t have the lights up, but, okay, if there’s any hand, I might be able to see you.

Klein: It’s like my living room.

Kirkpatrick: There’s a hand back there, let’s get—oh, Alex, please, go for it. Wait, get the mike, hold on.

Merle: Sure, my name is Alex Merle, I work mostly in cybersecurity and countering disinformation, but my comment, I guess, is about Uber and you said it’s trying to arbitrage on benefits but it’s trying to arbitrage drivers away, right? I mean, it’s play is to eliminate drivers and it will only ever be profitable if it does that. So I think it’s optimistic to say that they’re only trying to arbitrage benefits and I think there’s going to—

Kirkpatrick: There are two different criticisms but they’re both criticisms.

Merle: It goes back to the growth issue, so I’d actually be curious, your comment on the first talk about growth. To me, growth is also a problem. I’ve actually never quite been able to wrap my head around it needs to be 6% or 9% better the next year. Like, why isn’t today okay?

Kirkpatrick: Good question.

Klein: Well, and I agree. I mean, I think growth, it’s one of the things that I think when we spend time talking to founders, we try and figure out as to whether the boundaries that they’re going to pass in order to achieve that growth. I mean, one of the challenges, we can all point to Uber and say, “Oh, Uber is evil,” but the reality is we as consumers benefited greatly from it, right? Like, we can vote with our dollars too and choose. I mean, in the early days when it first came out that Uber was calling up drivers and then cancelling, I stopped using Uber. I instead started using Lyft because I wanted to try and support the underdog.

Part of the reason why I’m excited that we’re all talking about it is because it’s not going to be one magic cure-all. It really is going to take a community to solve this and part of that means we, as consumers, have a responsibility to pay more, to kind of reward greatness.

Kirkpatrick: So did you see, hear Doug’s comments as extreme or did you think that’s a healthy mindset?

Klein: I think it’s healthy for conversation which is what we need. So for too long it’s been—you know, the reality is every company now is a tech company, every city should be a tech company and there’s too much tension around what tech is and I think Amazon’s, “I’m not coming to New York,” and some of the backlash around that shows that we’re not bringing up communities to feel comfortable with tech. And tech has to take the leadership role here and be doing good in order to bring the community along. And there has to be a whole lot more transparency around how we’re working to solve it.

Kirkpatrick: Yes. We are keeping up the velocity…