Inflation is a financial specter that spooks investors and destabilizes economies. For a time, it seemed as if the Federal Reserve had tamed this beast under the helm of Paul Volker. However, like a resilient villain in a horror movie franchise, inflation is returning. As it steals the purchasing power of assets and makes future financial goals more elusive, investors are desperate for viable protective strategies.

In the latest edition of Worth Knowing, we had the opportunity to sit down with Nancy Davis, Portfolio Manager of The Quadratic Interest Rate Volatility and Inflation Hedge ETF (NYSE: IVOL), to discuss this pressing issue. Davis is no stranger to market intricacies; she is the Founder and Chief Investment Officer of Quadratic Capital and has previously been the Head of Credit, Derivatives, and OTC Trading at Goldman Sachs’ prop group. Her ETF, IVOL, was named the Best New US Fixed Income ETF of the Year when it was launched in 2019.

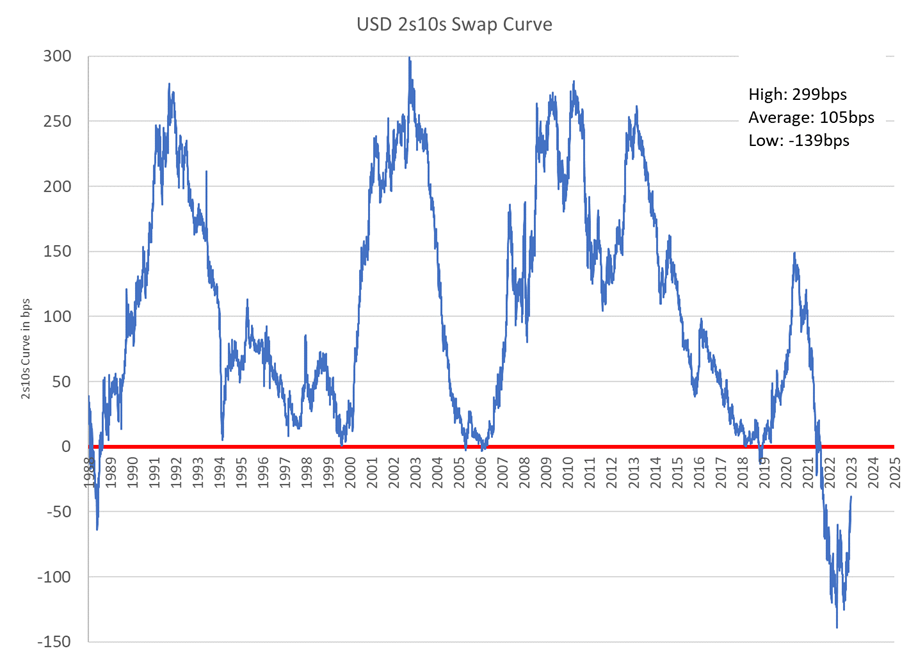

Making Sense of Inverted Yield Curves

One of the most critical market indicators Davis follows is the yield curve, especially when it’s in an inverted state. Yield curve inversions—where short-term interest rates are higher than long-term ones—have historically preceded recessions. Davis simplified the concept, likening the yield curve to a teacher who clues you into what’s likely coming in the economic exam. Currently, that curve is cautioning investors about impending financial turbulence.

The crux of our discussion revolved around IVOL as an instrument designed to navigate these choppy financial waters. Davis elaborated on how her ETF stands apart from traditional protective securities like Treasury Inflation-Protected Securities (TIPS). While TIPS can offer some inflation protection, they are confined to the CPI (Consumer Price Index) and have limitations on duration and zero bounds on inflation.

The IVOL Strategy

So, what exactly is in IVOL’s toolkit? Davis explained that IVOL holds a blend of TIPS and options on inflation expectations. This blend allows it to perform well even in ‘risk-off’ periods. For instance, during the recent SVB banking stress, IVOL’s returns exceeded 14% as the curve steepened and market volatility increased. IVOL offers investors a unique proposition: access to over-the-counter (OTC) markets, which were traditionally off-limits to retail investors in ETFs.

More importantly, IVOL is designed as a hedge against inflation. This access to a broader range of assets and markets is key to IVOL’s strategy for inflation protection.

A Versatile Investment Vehicle

In this era of uncertainties, IVOL provides a multifaceted investment vehicle. Its utility is not confined to a single investment category. As Davis puts it, investors have utilized IVOL to complete their Aggregate Bond allocations, replace TIPS, diversify equity risk, and more. Moreover, IVOL offers distributions, providing at least 30 monthly basis points, adding another layer of appeal for income-focused investors.

Navigating today’s market complexities requires innovation and a willingness to tread uncharted territories. Davis has engineered IVOL to do precisely that—provide investors with a protective hedge against volatile markets and inflationary pressures. With the NY Fed signaling a 60% chance of recession based on yield curve metrics and uncertainties like government shutdowns looming, investors would do well to consider diversifying their portfolios. IVOL is a testament to financial ingenuity and a beacon in these uncertain times.

To delve deeper into this revolutionary ETF, visit www.ivoletf.com. You can watch the entire conversation with Nancy below.

The video contains Nancy Davis’ opinion regarding the market. It should not be regarded as investment or tax advice, or recommendation of specific securities.

To determine if IVOL is an appropriate investment for you, carefully consider the fund’s investment objectives, risk, and charges and expenses. This and other information can be found in the fund’s prospectus, and the summary prospectus, which can be obtained by clicking here. Please read the prospectus, or the summary prospectus, carefully before investing.

For IVOL standard performance as of the most recent calendar quarter and month-end, unsubsidized 30-day SEC Yield, top 10 holdings, risks, and other fund information, please click here. For a glossary of definitions click here.

There are risks involved with investing, including loss of principal. IVOL is distributed by SEI Investments Distribution Co. (SIDCO), 1 Freedom Valley Drive, Oaks, PA 19456. The Fund’s sub-adviser is Quadratic Capital Management LLC (Quadratic). SIDCO is not affiliated with Quadratic or Worth.