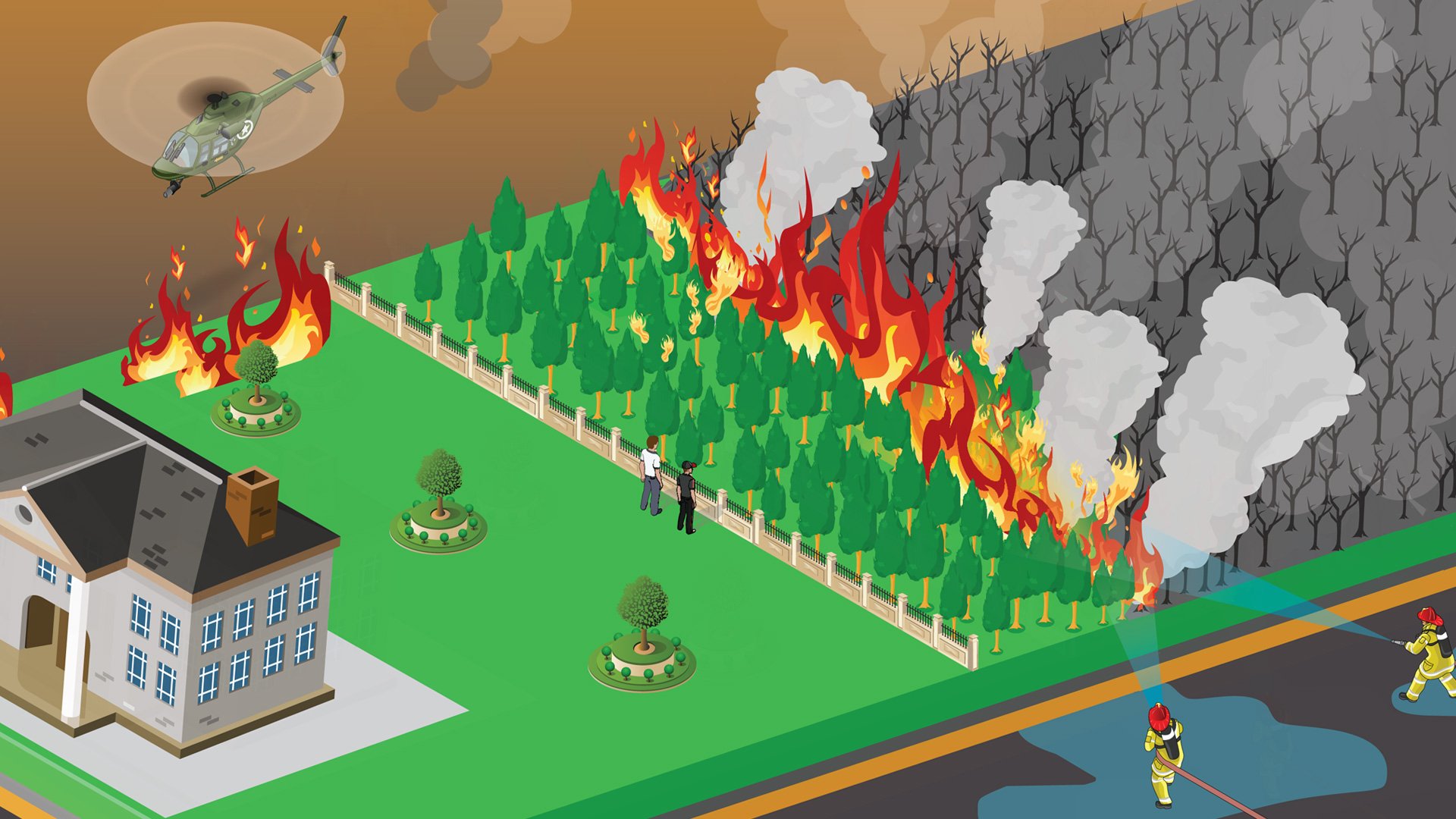

01. Create a Defensible Space

Defensible space is the buffer between your home and the impending wildfire. Steve Quarles, senior scientist at the Insurance Institute for Business and Home Safety, recommends breaking defensible space into three zones: a noncombustible zone, which encompasses the first five feet around a building and any decks; a firebreak zone, from five to 30 feet; and a reduced fuel zone, from 30 to 100 feet away from exterior walls (or as far as your property line extends). The noncombustible zone is your home’s last chance at survival, so consider installing rock mulch, hardscaping or, if you must, low-combustibility vegetation. If you have a deck, “don’t store anything combustible under it,” says Quarles. Keep the firebreak zone free of dead grass and leaves, and, “if you keep firewood on hand in the winter, make sure that the woodpile is far from the home come summer,” says Michele Steinberg, Firewise communities program manager at the National Fire Protection Association.

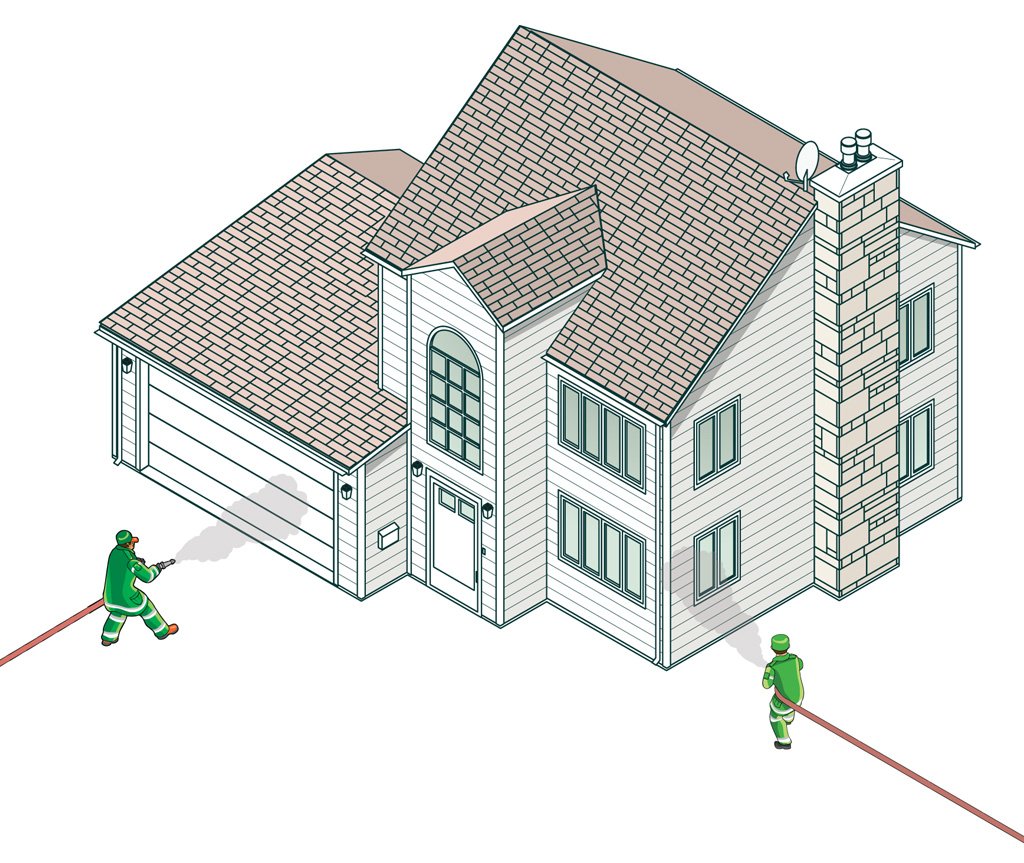

02. Fireproof Your Home

Robin Donaldson, a partner at architecture firm Shubin + Donaldson, cites two main principles in constructing fire-resistant homes: active fire protection such as foams, gels and sprinkler systems, and passive fire protection. “If you invest in an active system, you don’t have to put as much thought into passive systems,” says Donaldson. On the other hand, passive systems don’t require anyone to turn them on, notes Carole Walker, executive director at the Rocky Mountain Insurance Information Association. The key elements in passive systems are the roof, windows and siding. “The roof covering and assembly should be class A”— meaning able to withstand large, burning materials—says Steinberg. Windows and siding need to survive radiant heat. Windows should be dual-paned or made of tempered glass, and siding should be nonflammable or low-combustible. “If you have a well built home and a nonflammable roof, you’ve conquered a lot of the problems,” says Steinberg.

03. Take Advantage of a Wildfire Protection Program

As the risk of wildfires increases, home insurance providers are getting more proactive. Clients who enroll in wildfire protection services, such as the Wildfire Protection Unit offered by AIG, work with AIG wildfire mitigation specialists to determine a mitigation and loss-prevention plan. This may include the application of a fire-retardant spray in non-irrigated brush areas, as well as customized advice and an action plan for the homeowner and caretaker in the maintenance of ember-attracting fuel sources such as yards and gutters. “You’re not going to eliminate the risk of fire, but there’s a lot that can be done proactively,” says Roberto Stewart, VP of loss prevention for AIG Private Client Group. These services will also dispatch mitigation specialists during a fire, and if the home is threatened, apply class A foam to the home or spray Phos-Chek, a long-term fire retardant, to brush or trees.

04. Take Inventory

“The home inventory is just so critical,” says Carole Walker. Keeping a detailed record of everything of value in your home may sound tedious, but “the [insurance] claims process is going to be much more difficult without it.” Software solutions such as the Insurance Information Institute’s Know Your Stuff Home Inventory can guide you through the process, and many insurance companies offer technology that can help. Or you can hire someone to do it, Walker says.

05. Pay Attention to Wildfire Signals

Wildfire season varies across the U.S., but not surprisingly, fires occur most often when an area is at its driest and hottest. Steinberg suggests paying attention to any red-flag warnings from your local weather service. And if you live in a wildfire prone area, says Quarles, “typically there will be some sort of organization like Firewise or the Fire Safe Council” providing information on preparation and evacuation. “Fire departments are usually happy to come to a residence, check it out and make suggestions about fire resistance,” Donaldson says.

06. Plan to Evacuate Long Before You Have To

“You don’t really want to start thinking about evacuation when it’s time to evacuate,” says Quarles . Decide what you’d take with you and plan accordingly. Important documents, including the home inventory, should be backed up online or stored in a secure offsite location. Every member of the household should have access to an emergency kit equipped with a list of contact numbers, nonperishable food, water, medications, extra clothing, a map of at least two evacuation routes and, most important, plenty of cash, says Stewart. If you have pets and domestic animals, make sure that someone is responsible for their safety and shelter. “When a wildfire is in the area, be vigilant and know where you want to go,” says Steve Quarles. You should have at least two evacuation routes: Consult your local Firewise community or fire department for help plotting these. And when the call to evacuate comes, don’t delay. “If a civilian dies, it’s often because they evacuated too late,” Quarles says.

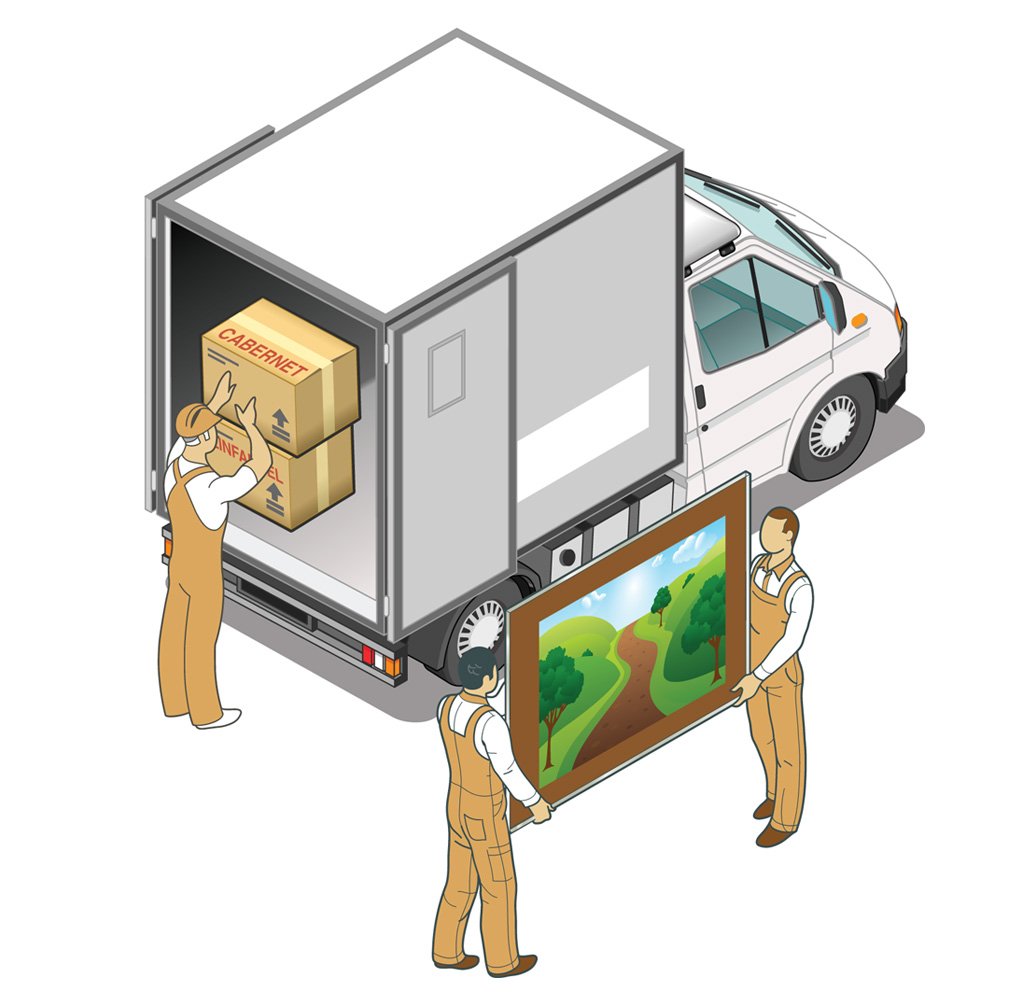

07. Secure Your Art

“Planning is very important, especially for collectors,” says Sharon Kauls, West Zone Client Advisory Leader at Marsh Private Client Services. Art demands a disaster preparedness plan encompassing records such as invoices, appraisals and detailed photographs, which need to be kept offsite, as well as a plan for transportation and storage. Know in advance “how your art could be de-installed, packaged by a trained art shipper and removed from the premises,” explains Robert Pittinger, VP and director of underwriting at AXA Art Americas. A fine art insurer will recommend art handlers, who can figure out which pieces require crates to be built, and fine art warehouses for storage. “Plan and take action in advance because once the evacuation order is implemented, it’s too late for a truck to come in,” says Pittinger. And if all else fails, have a fine art safe room—one with climate control, special security systems and no windows.

08. Protect Your Wine

First, consider how much wine you need to store on-premise. Marc Lazar, president of Cellar Advisors, says that his clients in wildfire-prone states tend to keep very little wine on-hand, “especially if it’s a vacation home.” If you insist upon keeping your best bottles where you can see them, you’ll want an insulation system, a sprinkler system and a backup generator. “When there’s a fire, authorities often turn off the power, and it’s very important that your wine stays cool and the humidity doesn’t go up,” says Stewart. Adds Lazar, “If you have collector’s or homeowner’s insurance that covers wine, make sure environmental issues are covered.” This includes damage from extremes of temperature caused by fire or a mechanical breakdown of cooling equipment, and water damage, which can occur if the sprinkler system causes flooding. But keeping an accurate inventory is “the best way to ensure you always know what you have and what it’s worth,” says Lazar.

09. Insure Everything and Follow Up Right Away

While most homeowner’s policies cover wildfires, the extent of that coverage may vary dramatically. “If you have a customized home, have an independent appraisal and make sure your insurance company is aware you have a custom build,” says Walker. Kauls recommends choosing a broker and insurance carrier that specializes in high-value property. In addition to adequately insuring your home, these professionals can assist with disaster planning and post-incident arrangements. Schedule high-value items and collections separately; insurance providers can fully insure your art, jewelry and wine collections against natural disasters.

Then, as soon as it’s safe to return, contact your insurance provider; the company will send adjusters to assess home and collection damage. If relocation is necessary, Kauls says, the right insurance carrier and broker will give you a speedy leg up on everything from securing a 10,000-square-foot rental property to building a new custom home.

For more information, contact Robin Donaldson, Shubin + Donaldson, [email protected], 805.682.7000, shubinanddonaldson.com; Sharon Kauls, Marsh Private Client Services,[email protected], marsh.com; Marc Lazar, Cellar Advisors, [email protected], 314.667.5328, cellaradvisors.com; Robert H. Pittinger, AXA Art Americas Corporation, [email protected], 212.415.8405, axa-art-usa.com; Steve Quarles, Insurance Institute for Business and Home Safety, 803.789.4209, disastersafety.org; Michele Steinberg, National Fire Protection Association, [email protected], 617.984.7487, firewise.org; Roberto Stewart, AIG Private Client Group, [email protected], 786.425.4191, aig.com; Carole Walker, Rocky Mountain Insurance Information Association, 303.790.0216, rmiia.org.