FIN’s favorite post from 2020 was, hands down, Fintech and the Giving Season, in which we explored the many ways that fintech is transforming the world of charitable giving.

It’s pulse-pumping to survey the landscape in 2021 and realize how much has evolved. As with so many other aspects of financial life, the COVID pandemic accelerated digital charitable giving. Overall, charitable donations in the United States grew 2% in 2020, but online charitable donations rose 20.7% (even so, online donations still only make up 13% of all donations, and of those, 28% are made using a mobile app).

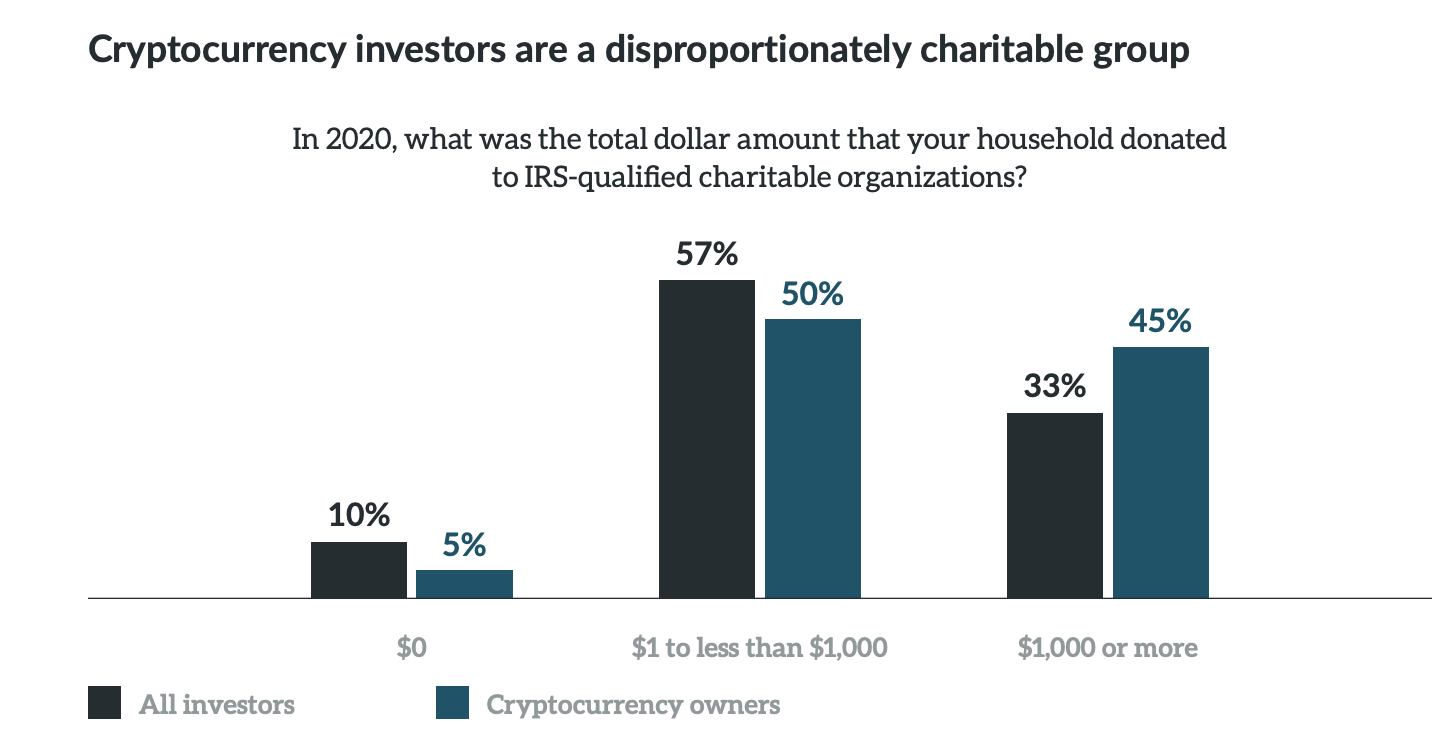

There is, naturally, much more to say this year about cryptocurrency and NFTs in the world of charitable giving. Plummeting markets in recent days may have left many crypto investors feeling Scrooge-like, but in general, according to a 2021 survey by Fidelity Charitable, cryptocurrency investors are more generous givers than average investors:

With eager donors like that, it’s not surprising that recently, American megafoundations such as American Cancer Society and Save the Children have enabled crypto donations. An organization called The Giving Block has helped hundreds of nonprofits set up a cryptodonation ecosystem.

Increasingly, NFTs are powering the world of charity. This year’s Macy’s parade, for example, gave away 9500 NFTs, and is auctioning off NFTs based on ten historic, parade-specific characters (as opposed to, say, copyrighted cartoons), with a portion of the sales going to the Make-a-Wish Foundation. Bids are open until November 30; as of Sunday morning, the NFT of a spaceman balloon from the 1950s had a bid of $340,000. Similarly, in September StreetCode Academy auctioned what it called “pNFTs,” philanthropic NFTs. The nonprofit pointedly said:

The NFT was selected because it’s a great example of how tech can benefit any creator, delivering a format where folks from any background can create, claim and benefit from their content, combating a pattern of art being co-opted and monetized without credit to the original creators.

StreetCode, according to a news account, received 60 bids and raised $15,000 between Sept. 15 and Sept. 30, a record pace.

Moving beyond the blockchain, in the realm of charitable giving, fintech is especially good at least two things. The first is making charitable donations into a group activity, something that would-be donors often want—especially in the wake of disaster—but are seldom set up to do.

In 2017, Hurricane Harvey devastated the city of Houston; at one point, a third of the city was underwater (nationwide the storm cost $125 billion, second only to Hurricane Katrina). The NFL defensive end J.J. Watt, then playing for the Houston Texans, organized a crowdfunding campaign for Houston that raised an unprecedented $41.6 million. Jonathan Shugart, an Alabama-based “recovering tax attorney” looked at Watt’s effort—and similar crowdfunded charitable campaigns—and realized that much of what Watt raised was not in the form of a charitable donation. The Internal Revenue Service (IRS) treats such transactions as a peer-to-peer gift—with no tax deduction available—and worse: if the donation is over $15,000, the donor technically has to file a gift tax return. Shugart told FIN that he had a light-bulb moment: “There’s got to be a better way if we want to do crowdfunding for charitable good.”

He launched B Charitable this year after about a year of wrangling with the IRS to get its 501c(3) status. B Charitable allows individuals or groups to set up a charitable giving fund and realize an immediate tax benefit. Once a campaign is created, others can join in and also get tax deductions for their contributions. The funds can be dispersed all at once or over time. Shugart argues that most technology enables charities to pull money in; he wants B Charitable to act as a push on donors. B Charitable itself is a nonprofit that tries to keep the overhead low; it contracts out for services and Shugart says it hopes that some donors will include B Charitable along with the target charities: “We ask for tips, we don’t require them.”

The second thing is integrating charitable giving into everyday life. The outfit once known as Pledgeling did at least two big things in 2021: it changed its name to Pledge and became a fully integrated partner with Zoom, which has become an essential part of everyday life. Now, when a nonprofit holds a Zoom call for interested parties, it can easily include a DONATE button powered by Pledge. The nonprofit raised $3 million in seed money this year for its video efforts.

Perhaps the grandest charity fintech of all is the Washington, DC-based Goodworld. New Zealand native Dale Nirvani Pfeifer told FIN that she realized a technology gap in nonprofit fundraising shortly after she moved to the US. She met her cofounder John Gossart at the DC startup incubator 1776, and by 2018 they had investments from the city of DC and Mastercard. Since COVID hit, Goodworld has focused on building out donation software for businesses and nonprofits. Increasingly, Pfeifer says, small- and medium-sized businesses want to integrate giving to social causes into their daily commerce: “What is expected of companies is changing and, you know, it’s really being demanded by consumers and by employees.” Goodworld’s next step, she says, is taking its operation global.

PayPal’s FreeFall

Through most of the first half of 2021, the following sentence was all but inconceivable: It is possible, indeed likely, that PayPal stock (PYPL) will close 2021 below its year-opening price of $231.92 a share.

As the chart below shows, PYPL has had a disastrous second half:

Aside from the obvious premise that the stock was overpriced, it’s hard to pinpoint exactly what caused it to tumble. Yes, there was a sugar-high aspect to the benefits brought on by the COVID lockdown (which made contactless payments more appealing) and then stimulus payments. But that is also true for rival Square, which hasn’t been hit quite as hard. On November 17, Bernstein downgraded PayPal stock from a buy to a hold, citing increased payment competition from the likes of Amazon and Shopify: “PayPal now risks getting disrupted vs. being a disruptor.”

What’s curious, even confounding, about the Bernstein downgrade is that it could have been issued any time over the last several months. More important, the downgrade clearly didn’t cause the PYPL free fall, only accelerated it. PayPal shareholders are no doubt hoping that management has better answers than that bizarre, quickly abandoned move to buy Pinterest.

This piece originally appeared in FIN, James Ledbetter’s fintech newsletter. Ledbetter is Chief Content Officer of Clarim Media, which owns Techonomy.