Conversation throughout the Digital Health Summit, which took place alongside CES in Las Vegas early this month, was less about technology and more about behavior — the behavior of patients, of providers, and of institutions.

The summit stage featured speakers enthusiastically touting an array of technological advancements. They included alternatives to pharmaceuticals for pain relief, as well as games and wearables that use biofeedback to help patients with diseases such as autism, Alzheimer’s, depression and stroke recovery. There was also great enthusiasm for big data as a driver of patient management, among many other promising breakthroughs.

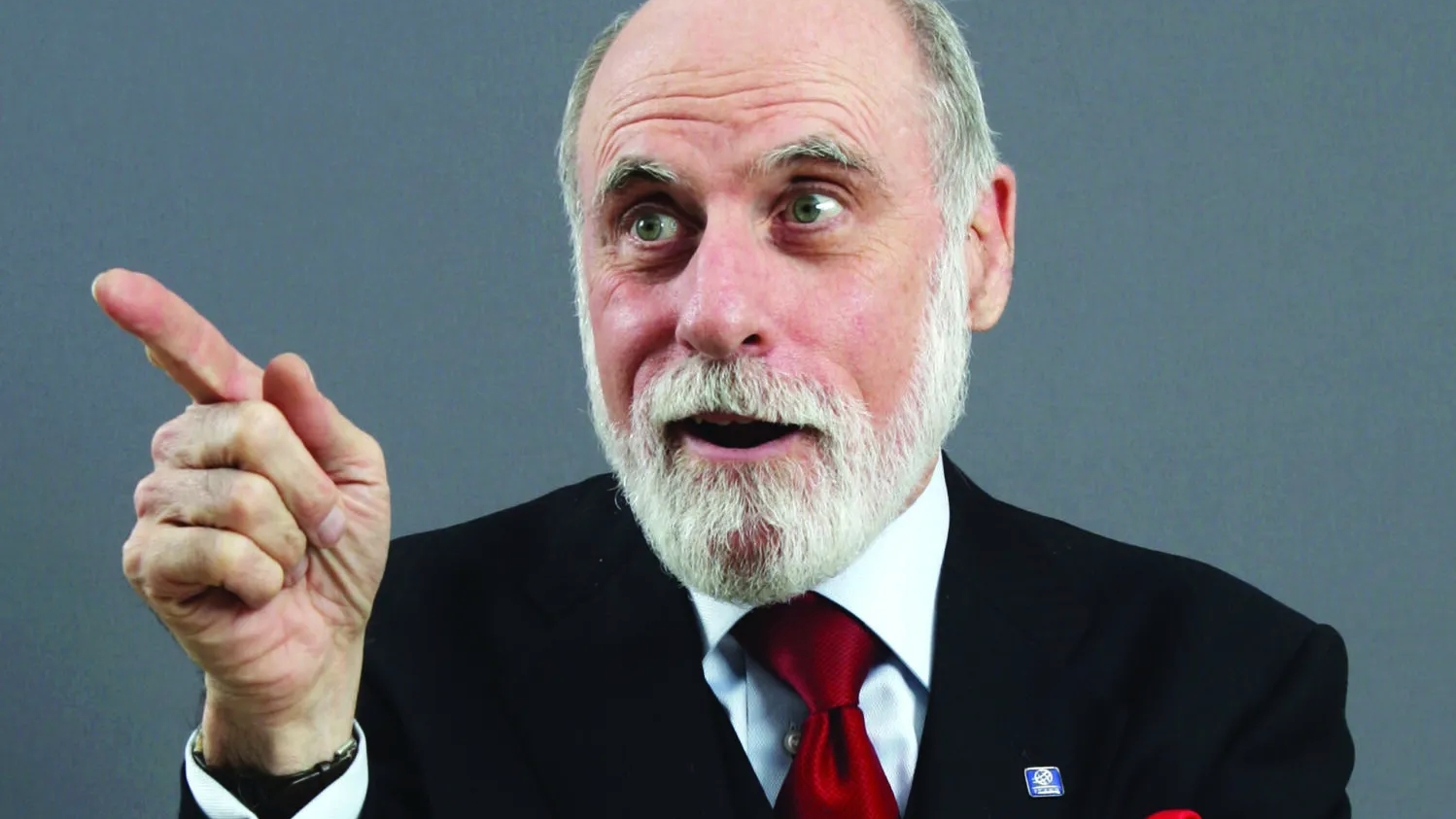

But talk in the hallways was more reserved. Conversations at a leadership dinner attended by more than a dozen healthcare innovators that was hosted by Johnson & Johnson and moderated by Techonomy Media CEO David Kirkpatrick, for instance, focused on the gap between technological advancements and the adoption of these breakthroughs by both patients and providers.

While early adopters are proving the promise of many digital tactics, large-scale behavior change among both consumers and healthcare institutions is going to take time, they say.

“At the end of the day,” one startup founder said, “It’s about how you deal with people. How do we influence behavior — consumer behavior and physician behavior?”

That question resonated throughout the halls of CES, with many startups saying it is their biggest challenge. Behavior change, they say, is their way to join the system. “We have physician behavior and patient expectations,” Dr. Shai Gozani, CEO of Quell, an over-the-counter wearable for pain relief, said during one summit panel. “How can technology get in the middle of this?”

“Behavior change happens when motivation, capability and opportunity converge at the same moment,” said Len Greer, President of Johnson & Johnson Health and Wellness Solutions. “There’s no doubt that technology has the potential to significantly improve provider-patient interactions as well as consumers’ health behaviors. We know that adoption of new healthy behaviors — or extinguishing existing unhealthy behaviors — requires a sustained amount of physical, emotional, and mental energy to maintain focus, discipline, and desire to change.”

At its broadest, the question becomes one of interoperability within existing systems and between the startup community and the big healthcare institutions.

“The traditional healthcare system is slow to change and not open to integration,” said the CEO of a company that measures and creates personalized programs to sharpen memory for Alzheimer’s patients.

Digital transformation, however, is not the biggest disruptor. That, rather, is the industrywide shift away from treating disease and instead toward keeping people healthy.

The movement from taking care of sick people to keeping them well has opened the door for digital transformation by putting consumers at the center of the industry. Empowered consumers demand the insight and tools to manage their own cases. But unlike their consumer-focused counterparts at the broader CES who can gleefully seek to “disrupt,” the challenge for healthcare entrepreneurs is to integrate within the existing healthcare industry. They seek to encourage adoption of alternative approaches, not to unseat the existing system, which is well embedded, highly regulated, and deeply specialized.

Those shuffling between the CES Digital Health Summit and the J.P. Morgan Healthcare Conference in San Francisco, which took place the same week, may have experienced something akin to vertigo. The J.P. Morgan conference focuses on the investment opportunities of the industry and more than 20 of the country’s largest healthcare systems presented their strategy there. With hospital profits and cash reserves at historic highs, many are focused on attaining scale. Case in point: among the presenters were executives representing two recent mega-mergers — Illinois-based Advocate and Wisconsin-based Aurora, which will be a $10 billion organization with 70,000 employees; and California-based Dignity Health and Colorado-based Catholic Health Initiatives, which combined will have $28 billion in revenues and 160,000 employees.

Against such a backdrop, many digital health startups are scaling back their ambitions to focus on very specific problems rather than taking on larger, systematic issues.

Still, talk from the healthcare startups and the big institutions was not all that different, with both putting moving away from technology for technology’s sake and placing increased emphasis on delivering real value.

“Anything can be technologized,” one startup founder said. “But what is the problem we are solving?”

Editor’s note: Our coverage of CES is sponsored by Johnson & Johnson.