This piece originally appeared in FIN, James Ledbetter’s fintech newsletter.

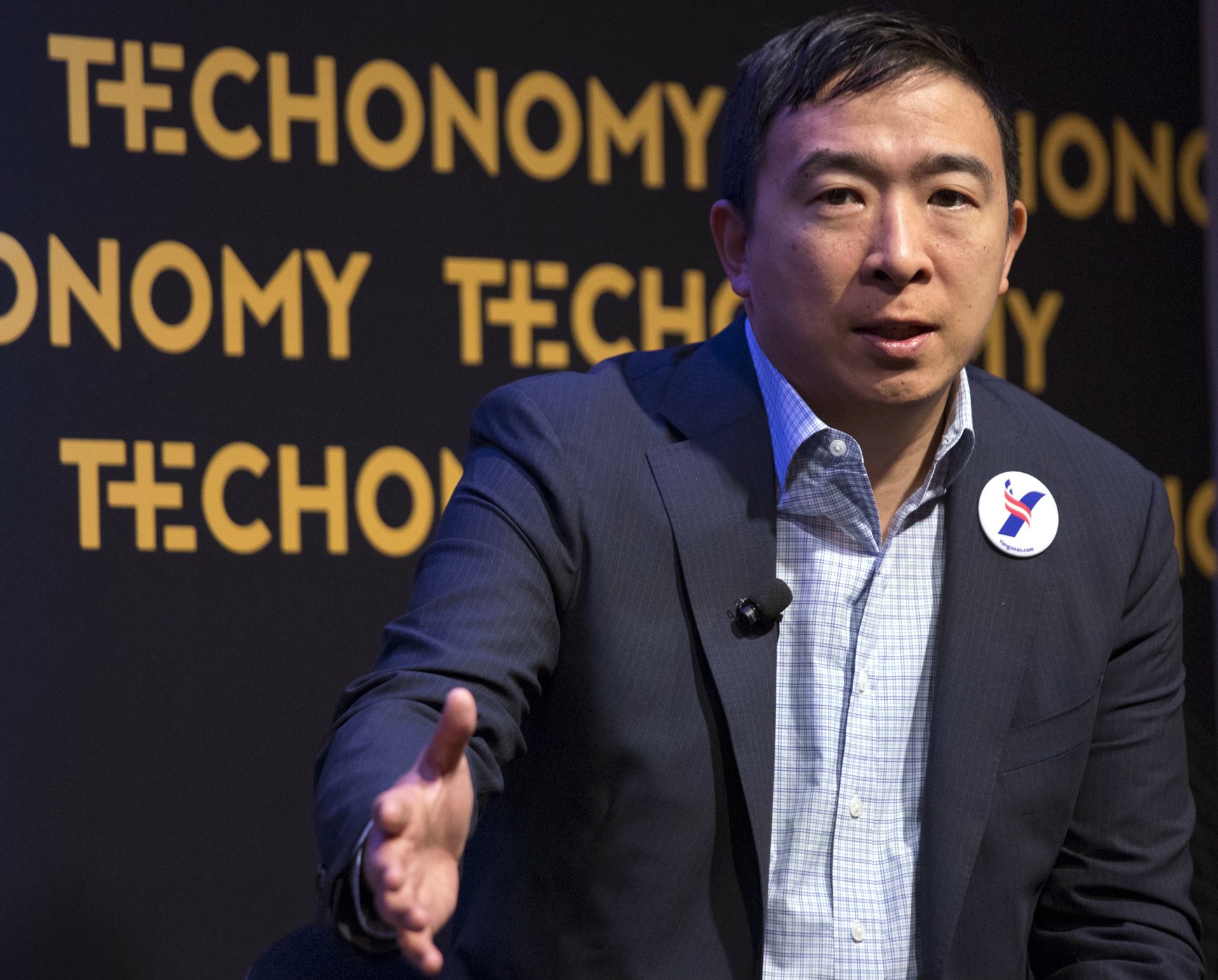

FIN has never known entirely what to make of Andrew Yang. When he ran for president in 2020, he was little more than a novelty act, although his passion for Universal Basic Income was interesting and distinctive. His current effort to become mayor of New York City seemed initially almost as implausible, but opinion polls for months have consistently shown him as the front-runner in the crowded race and, with the June Democratic primary likely to determine the November winner, there is a very good chance that Yang will be the next mayor of America’s largest city.

Part of Yang’s palpable but somewhat opaque appeal is that he paints himself as a tech guru/advocate. Here is an example relevant to the FIN world:

No doubt some New York voters find this pledge appealing, and it helps Yang position himself as a forward-looking, tech-savvy candidate, in striking contrast to the rest of the oversized Democratic field, which is so many flavors of lackluster.

But—and this is a consistent challenge for Yang as a mayoral candidate—pronouncements like this make people who follow the issue scratch their heads in bewilderment. For starters, there is an ideological problem: the New York City primary electorate is fairly left-wing, and climate change is a major issue for those voters, as Yang, who has labeled climate change “a matter of life and death,” well knows. Given the amount of energy required to mine cryptocurrency, it’s entirely predictable that Yang would come under fire for this proposal. (Yang’s campaign did not respond to FIN’s request for comment.)

On this point, FIN is a little more forgiving than some. While it’s undeniable that cryptocurrency mining chews up huge amounts of energy, almost no one makes the baseline comparisons: how much energy is required to print paper bills and mint metal coins, and then ship them around the world? What if the blockchain that underlies cryptocurrencies could be deployed to create more efficient transactions and therefore reduce energy usage? And a rational carbon tax could help manage all these issues.

But there is a more immediate problem with Yang’s idea to make NYC a crypto hub: the law in New York State. As far back as 2013, New York regulators expressed concern about Bitcoin and cryptocurrency, citing the usual regulatory issues, mainly the potential for fraud and nefarious activity (money laundering, drug smuggling, etc). As has often been the case in cryptocurrency regulation, it’s never been clear who exactly the state intended to go after. The regulation was intimately associated with Benjamin Lawsky, at the time the superintendent of New York State’s Department of Financial Services (DFS). Lawsky’s aggressive pursuit of banking fraud led to a 2013 Village Voice profile that depicted him as the sheriff of Wall Street:

In 2014, while the state was still working on its policy, Lawsky gave a speech at Cardozo Law School, in which he said that the regulation wouldn’t apply to software developers, Bitcoin miners, or individuals doing business in New York. But those presumed exemptions were never written into the regulatory language. In 2015, after the collapse of Bitcoin exchange Mt. Gox, New York State enacted a very broad regulation, making it illegal to “engage in any Virtual Currency Business Activity” without a state license. The license application is fairly onerous; some businesses grumbled that they were required to submit employee fingerprints to the state. As a result, some of the largest Bitcoin exchanges at the time—including Bitfinex and Kraken—simply decided to stop doing business in New York or handling accounts for New Yorkers.

Even before the regulation went into effect, Lawsky announced he was leaving DFS to launch his own consulting firm, creating what one attorney who specializes in blockchain technology calls “not a power vacuum, but a guidance vacuum.” Sarah Brennan, who heads the digital assets practice at the law firm Harter, Secrest & Emery, paints a picture of a clogged application pipeline and absentee regulators. “There was never any DFS response when we were working on projects,” she told FIN.

The situation has improved and evolved somewhat, Brennan said, with some new hires and a streamlined approval process (about two dozen companies have NYS “Bit licenses”). Enforcement has been minimal, but out of caution or spite most cutting-edge blockchain startups choose to be located somewhere outside New York. (New York’s state attorney general has also been fairly aggressive with cryptocurrency companies.) The law clearly never inhibited cryptocurrency mining; infamously, miners were attracted to a few depressed towns upstate because of cheap electricity. But as soon as they began operations they drove up the price of electricity for everyone, leading to municipal moratoriums and local resentment.

Which brings us back to Andrew Yang. The price of electricity in New York City (to say nothing of the environmental impact) presumably makes cryptocurrency mining a nonstarter. So what does it mean to be a crypto “hub”? It’s conceivable that New York City could deploy some kind of tax incentives to make it more desirable for blockchain companies to do business there, but if that is what Yang proposes he’s doing a very good job of keeping it a secret. Granted, Yang and New York City have bigger fish to fry, but Yang owes it to voters to explain his views on this issue beyond a tweet or two.

This piece originally appeared in FIN, James Ledbetter’s fintech newsletter. Ledbetter is Chief Content Officer of Clarim Media, which owns Techonomy.